Root Remedies address Root Problems

A philosopher once stated that the 1st step in resolving a problem is to ask the right question.

But before the right question can be asked, data & information about the true circumstances, and primary causes of “our collective problem(s)” is required.

For any city, county, or state government, the first question to be asked of any representative body that seeks to benefit the community s/he represents is Where will you find the money to do the good that you seek?

Invariably, our elected officials, many of whom are well trained in maintaining the status-quo, will acquiesce to those who finance their campaigns and who wield inordinate control of our elected bodies. Our ‘representatives’ unwittingly continue depositing our tax wealth in too-big-to-fail monopoly banks, as they do every day, day after day, year after year, election after election, sucking their constituents dry of their hard earned wages paid in taxes and distributing this wealth to a private banking cartel.

This, my friends, is the root problem.

Taxation that benefits the few at the expense of the many.

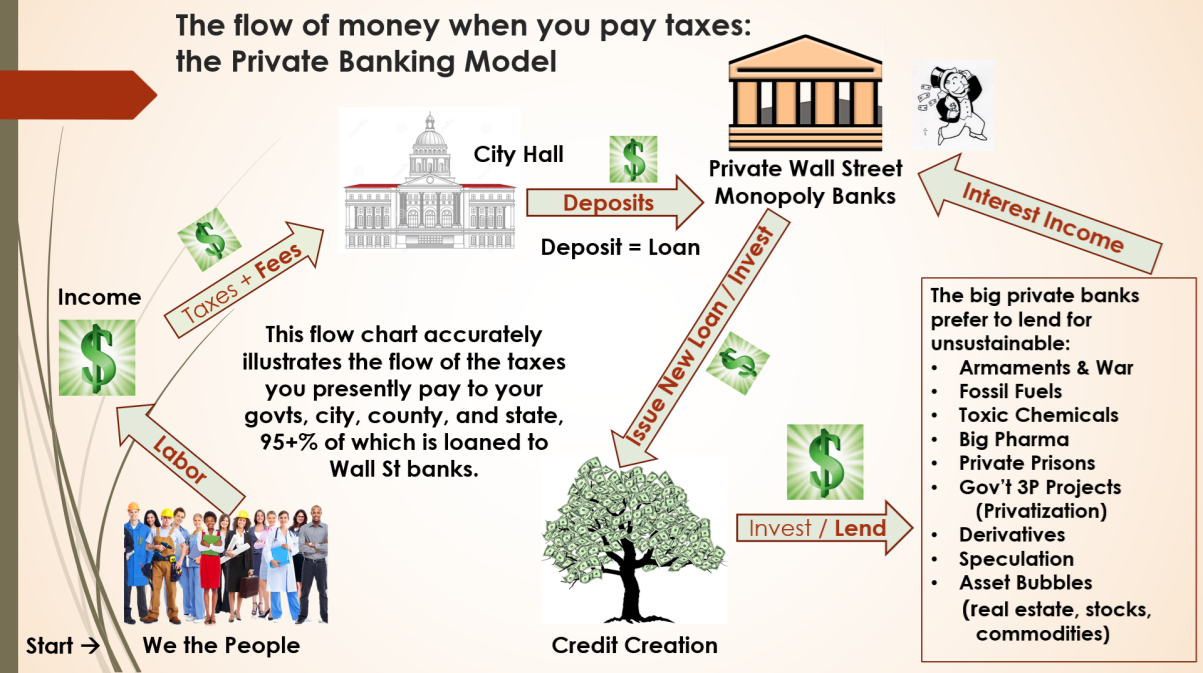

The image below (or to the right) illustrates what is happening every day when you pay your taxes to the city, county, state, and especially the national government.

The PRIVATE Banking Model

We work and earn an income.

We pay taxes to city, county, state, and especially national governments.

All our governments ‘deposit’ our money in these privately owned “too big to fail banks” TBTF banks.

And a ‘deposit’, in law & reality, is a ‘loan’ to the bank.

All our tax money leaves the taxed community (city, county, state) to Wall Street.

Where they build monopolies in every sector of the US economy.

And these TBTF banks finance everything that is wrong with our world: greed, plunder, exploitation, graft, and corruption.

Now that we’ve identified the root problem, we have narrowed our search for a Root Solution.

And it focuses our attention to taxation and banks, and begs the question:

Why are our taxes ‘loaned’ to these monopoly banks?

Isn’t there a better way? A different model of banking that would benefit the taxpaying community?

And the answer from the historical record of humanity, society, and banking is clear, there is!

And it is the Public Banking Model — where all the taxes of the taxpaying community are deposited (loaned) to a local bank owned by the governing body and its people, a Public Bank for your city chartered to reinvest only in the city in cooperation with local financial institutions and responsible to the local governing board, advisory council, community stakeholders, and the people within its jurisdiction.

A Local Public Bank:

The PUBLIC Banking Model

We work and earn an income.

We pay taxes to city, county, state, and especially national governments.

All our governments ‘deposit’ our money in a bank owned by the city, county, or state, chartered to invest exclusively in the jurisdiction they represent, or in joint projects with adjoining city, county, or state, public banks.

And since a ‘deposit’, in law & reality, is a ‘loan’ to the bank, in reality, a deposit in a public bank is a ‘loan’ to the community itself.

All our tax money remains in the taxed community : city, county, state.

And all our tax money is multiplied 10x or more with the powers that banks have in creating the money supply. Credit creation is the great secret of banking, but so far, in this nation there is only ONE public bank. And we need hundreds, and thousands, and tens of thousands of local public banks serving every city, county, and state in the nation, each one constrained to invest only within its local jurisdiction.

A dynamic economic engine is created with local public banks, a feedback loop of reinvesting our wealth directly into our communities: city, county, state.

What are Banks?

There are 3 competing and mutually exclusive theories on the role of banks in the economy. And according to international banking expert, Prof. Richard A. Werner, there has never been an empirical study of what happens internally in a bank when they issue you a loan for a car, a home, or a business...until now. The 3 theories are:

The Intermediation Theory

This theory is presently dominant in most economic textbooks, and has been in place since the 1960s. This theory of banking states that banks are just intermediaries between depositors and borrowers, as they charge a little interest for moving money between accounts. Nothing to see here with banks as their role in the economy is virtually insignificant. When you get a loan from the bank, money is transferred from one depositor’s account to another account, the bank collects a ‘small’ fee for its services (not so small these days…10% to 50% compounded daily?!!!)The Fractional Reserve Theory

The fractional reserve theory says that banks do not create money individually, but collectively, like magic, new money is created in the collective activity of all the banks. This theory was popular from the 1920s to the 1960s.The Credit Creation Theory

This is the oldest theory of banking, and simply stated, it asserts that banks create money whenever they issue a loan. This theory predates 1920 and is validated by the first-ever empirical study of what banks do when they provide loans, conducted by Professor Richard A. Werner. You can read the study here: Can banks individually create money out of nothing? Or watch this youtube informative video.Moreover, according to Prof. Werner, in law, a 'deposit' does not exist. It's a fiction conjured up by the banks. When you or your governments make a 'deposit' in a bank, you are making a 'loan' to the bank, and a transfer of ownership occurs: the bank becomes the new owner of your money, and you are considered one among many creditors. The bank makes a record of the IOU which the bank calls a 'deposit'. See Werner here

We should first establish our own State, County, City or Township Public Bank as sole depositories of our taxes, and chartered to reinvest that tax wealth ONLY in the local community, or in joint project with other adjacent publicly owned public banks (city, county, state).

The future is positive once we regain control of our taxes, and especially where they are deposited… for as we have seen, what we call a ‘deposit’ is legally and in reality a ‘loan’ to the bank.

Deposited, or more accurately, ‘loaned’ to a City-, County-, or State-Public Bank, that is chartered to finance only the jurisdiction it represents, our taxes can change our economic trajectory from poverty and debt to prosperity and profitability in relatively short order.

How is money created?

Centralized vs Decentralized Paradigms Examined. by Richard A. Werner

Summary: Banks create new money whenever they issue a loan. And centralized control of the monetary system is the dream of tyrants, giving us a dystopian future where every financial transaction is traced, traced, positioned, and reported to a centralized unelected body of self-appointed private banking profiteers, an Orwellian dystopia … enticed by a microchip implanted in your hand in exchange for a UBI, a Universal Basic Income.

Sound arguments against a CBDC, a Central Bank Digital Currency, and why we must resist.

#LocalPublicBanksInstead.